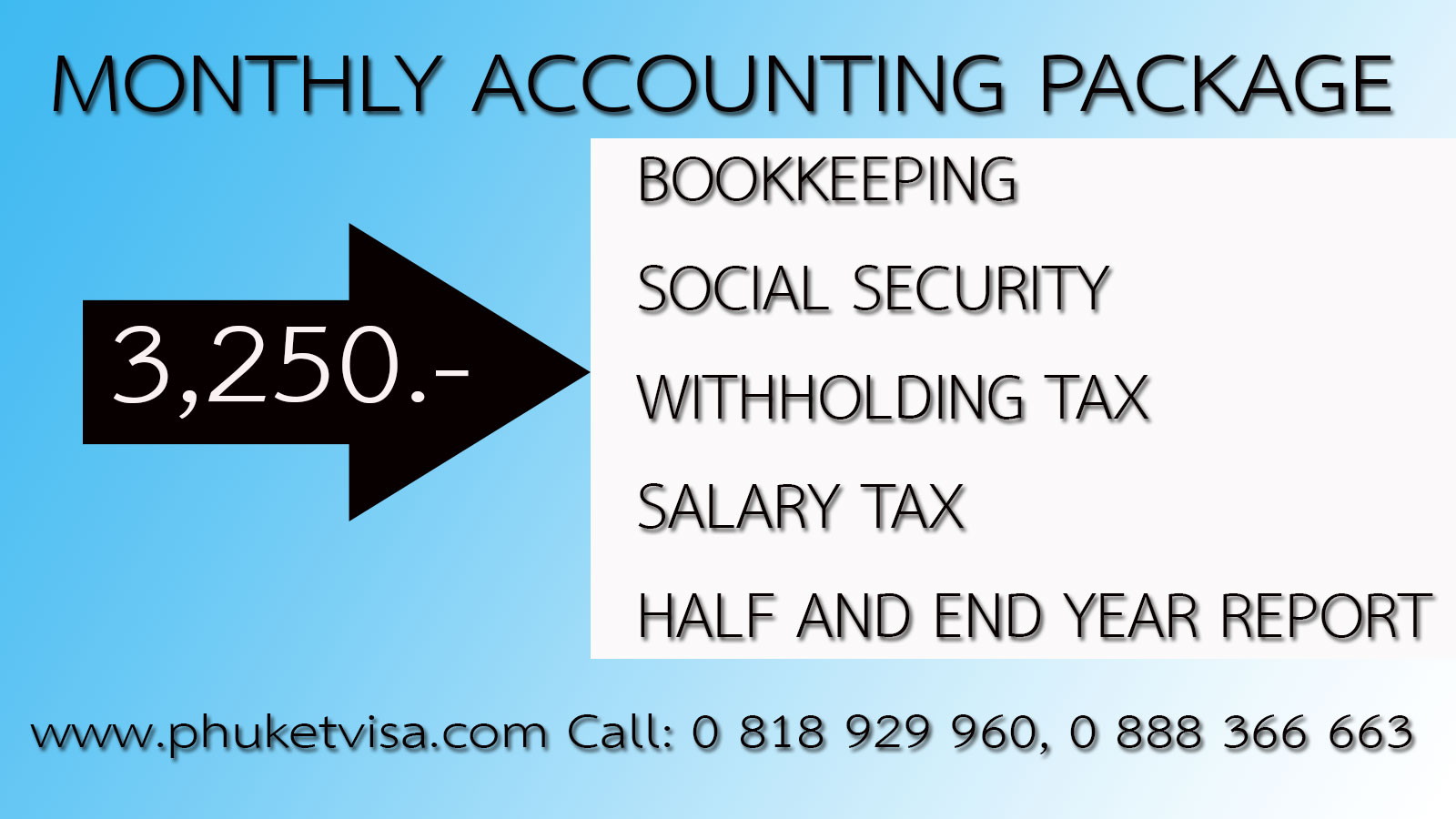

ACCOUNTING

Duties of Partnership Company

Limited Partnership or Registered Ordinary Partnership registered under Civil and Commercial Code must close account within 12 months from the date of the registration and file with the Business Development Office, Ministry of Commerce or Provincial Office within 5 months of the end of fiscal year even if the firm hasn’t been operated or temporary closed. Otherwise a penalty of maximum 50,000 Baht shall be applied.

Company Limited

1) A Company Limited should close account every 12 months. The performance record is to be certified by the company auditor, presented and approved by shareholders within 4 months after the account closure and submit to Business Development Office, Ministry of Commerce or Provincial Office within 1 mouth after the account approval even if the firm hasn’t been operated or temporary closed. Otherwise a penalty of maximum 50,000 Baht shall be applied.

2) A Company Limited should prepare a copy of current shareholder list and former shareholders who have ended their status after the last general meeting and submit to Business Development Office, Ministry of Commerce or Provincial Office within 14 days after the meeting date otherwise a penalty of maximum 10,000 Baht shall be applied.

3) A Company Limited should organize a general meeting within 6 months after the registration date and should organize at least 1 meeting every 12 months otherwise a penalty of maximum 20,000 Baht shall be applied.

4) A Company Limited should prepare and distribute stock bonds to shareholders otherwise a penalty of maximum 20,000 Baht shall be applied.

5) A Company Limited should keep book of company’s shareholder otherwise a penalty of maximum 20,000 Baht shall be applied.

In case a corporate registered fails to submit the annual account as stated by law, not only the corporate registered is guilty but also the managing partner, managing director or board of director who has the authority to act for the corporate registered are to received the same penalty as the corporate registered.

https://www.tfac.or.th/en/Home/Main

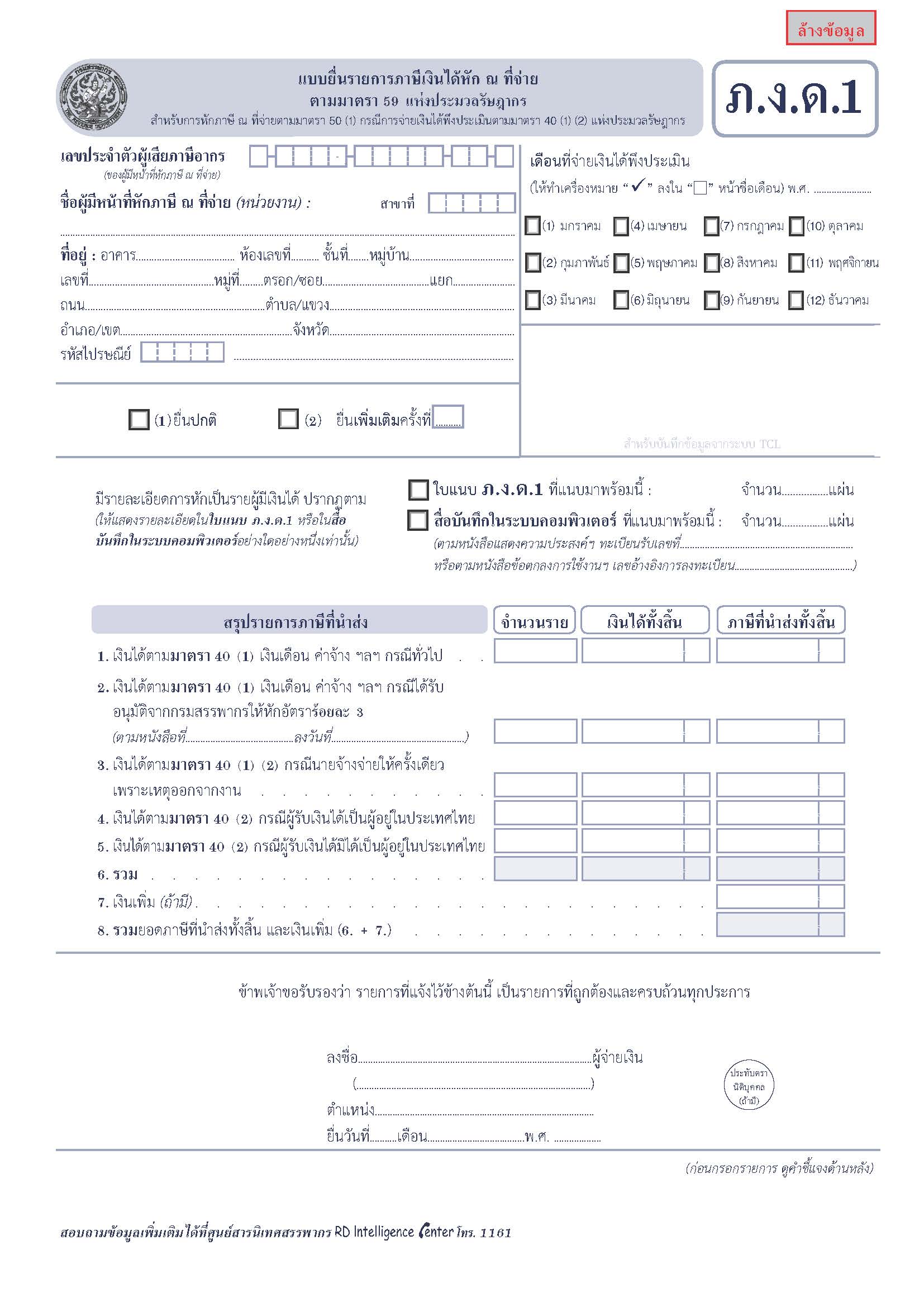

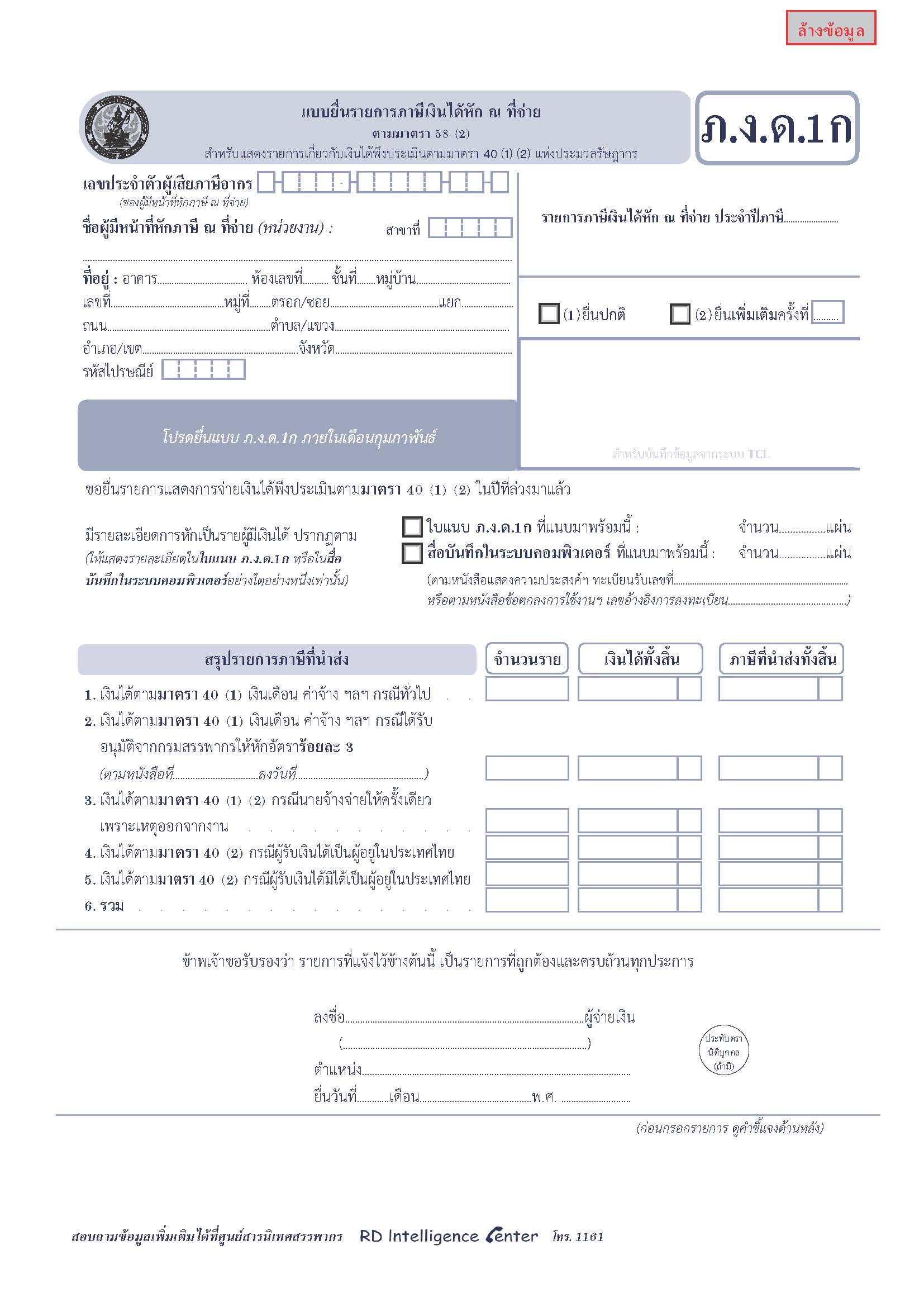

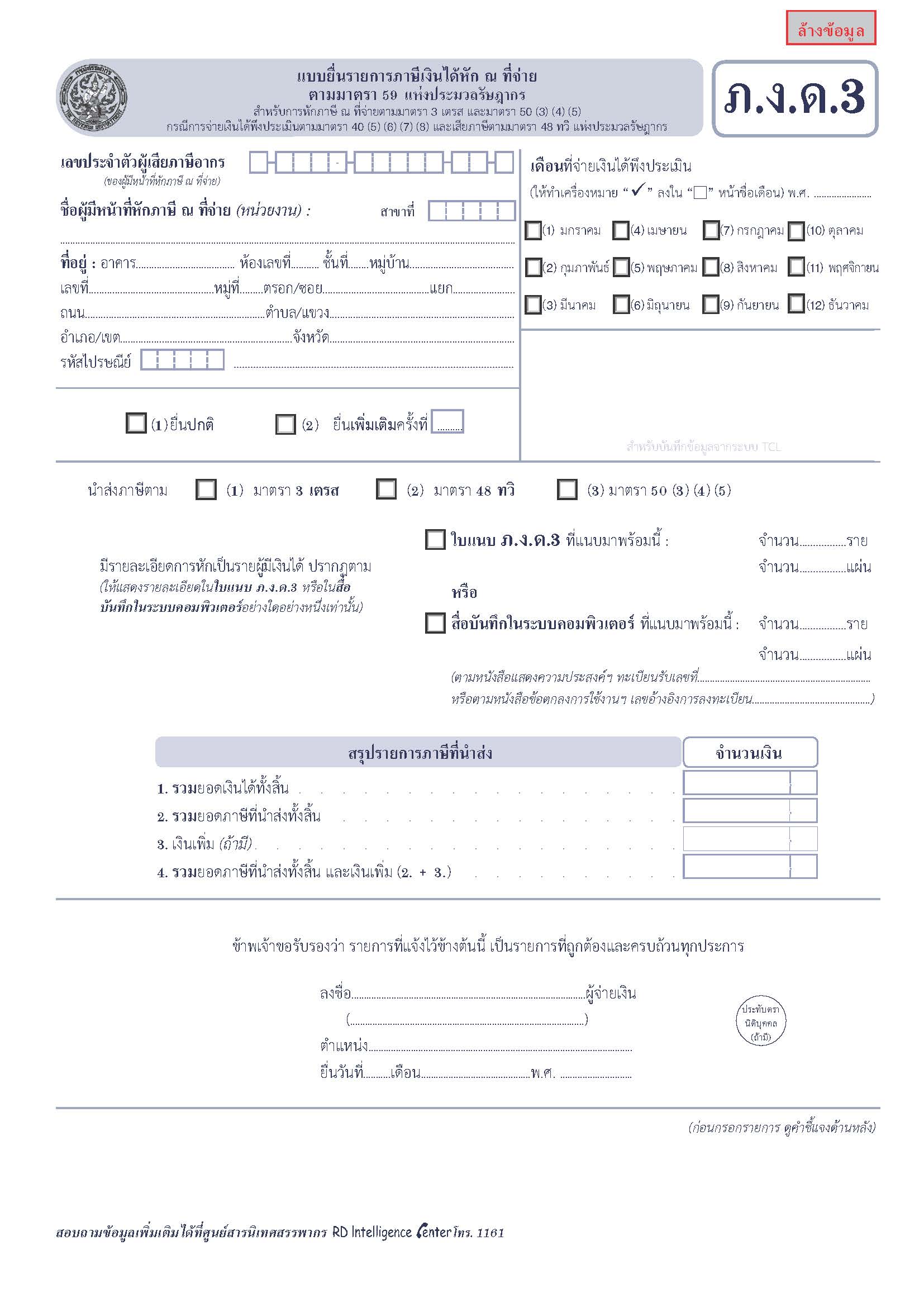

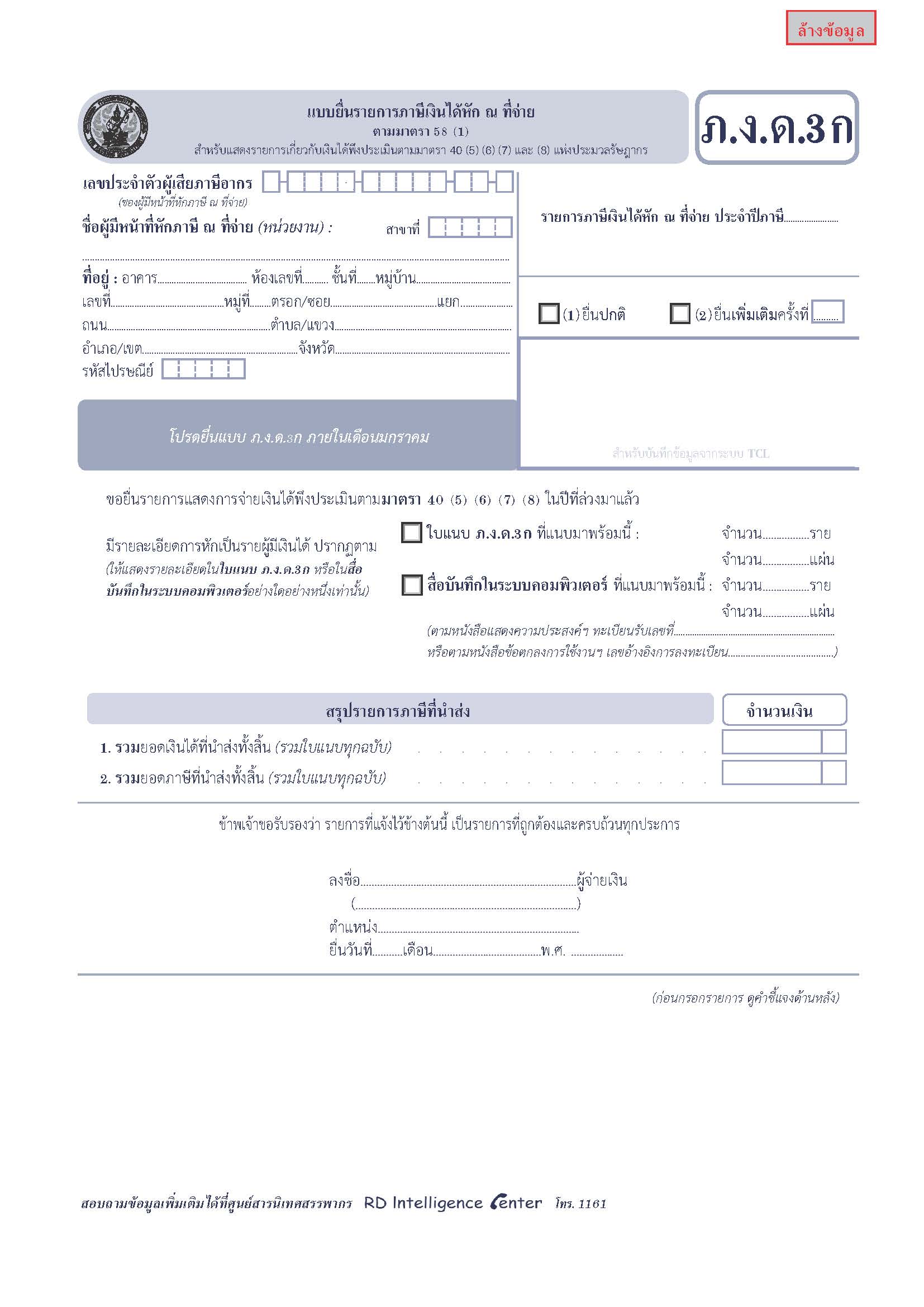

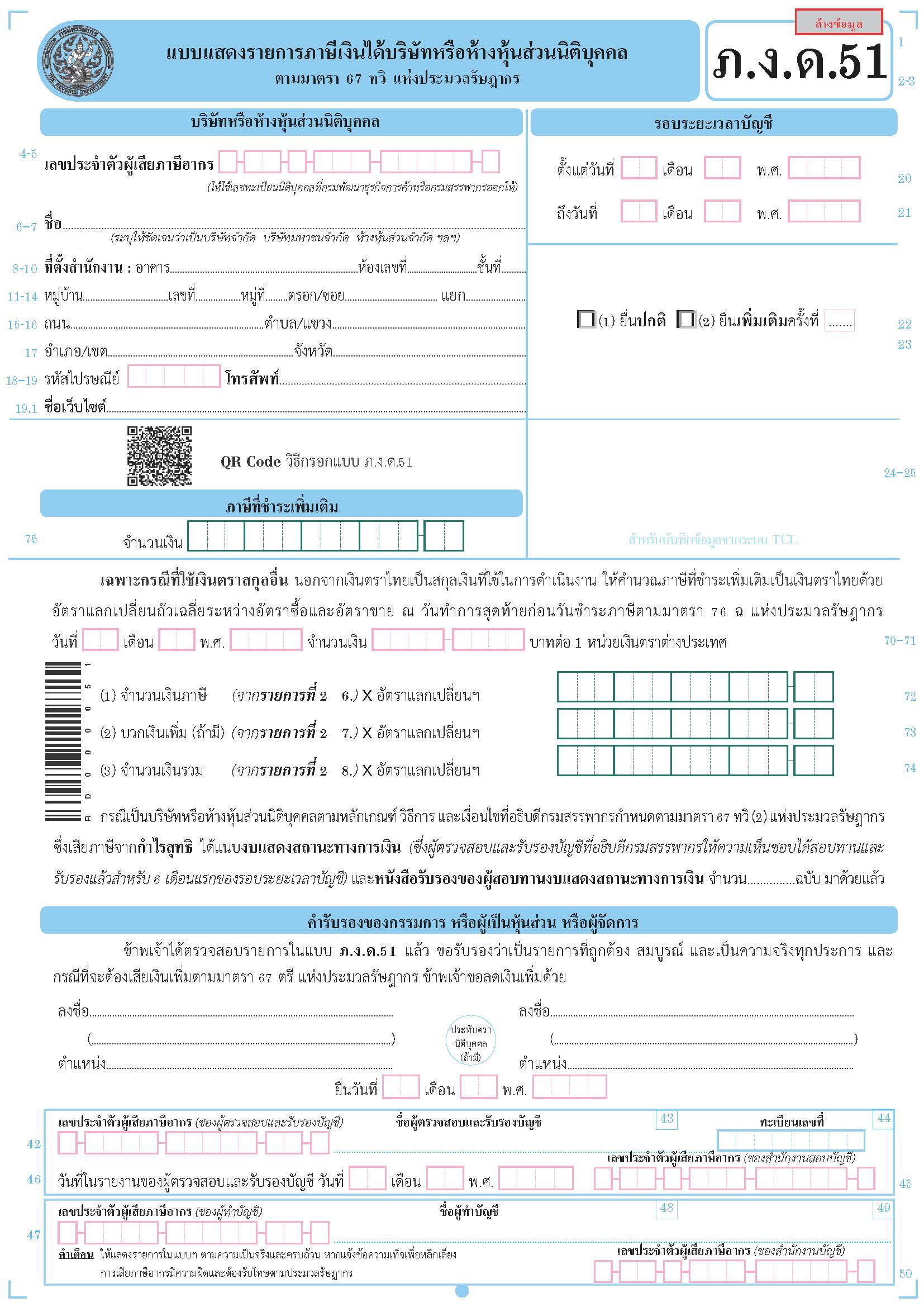

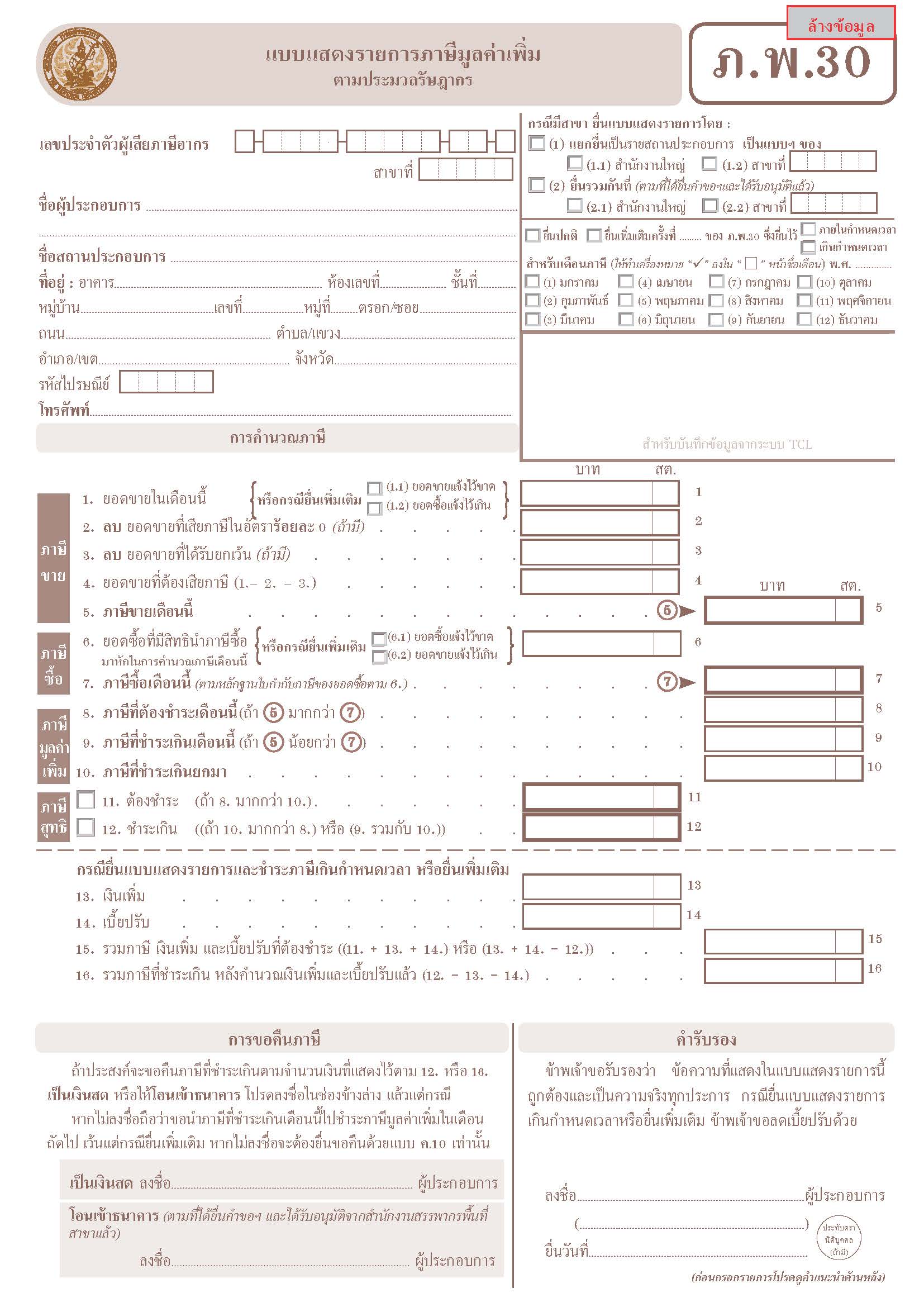

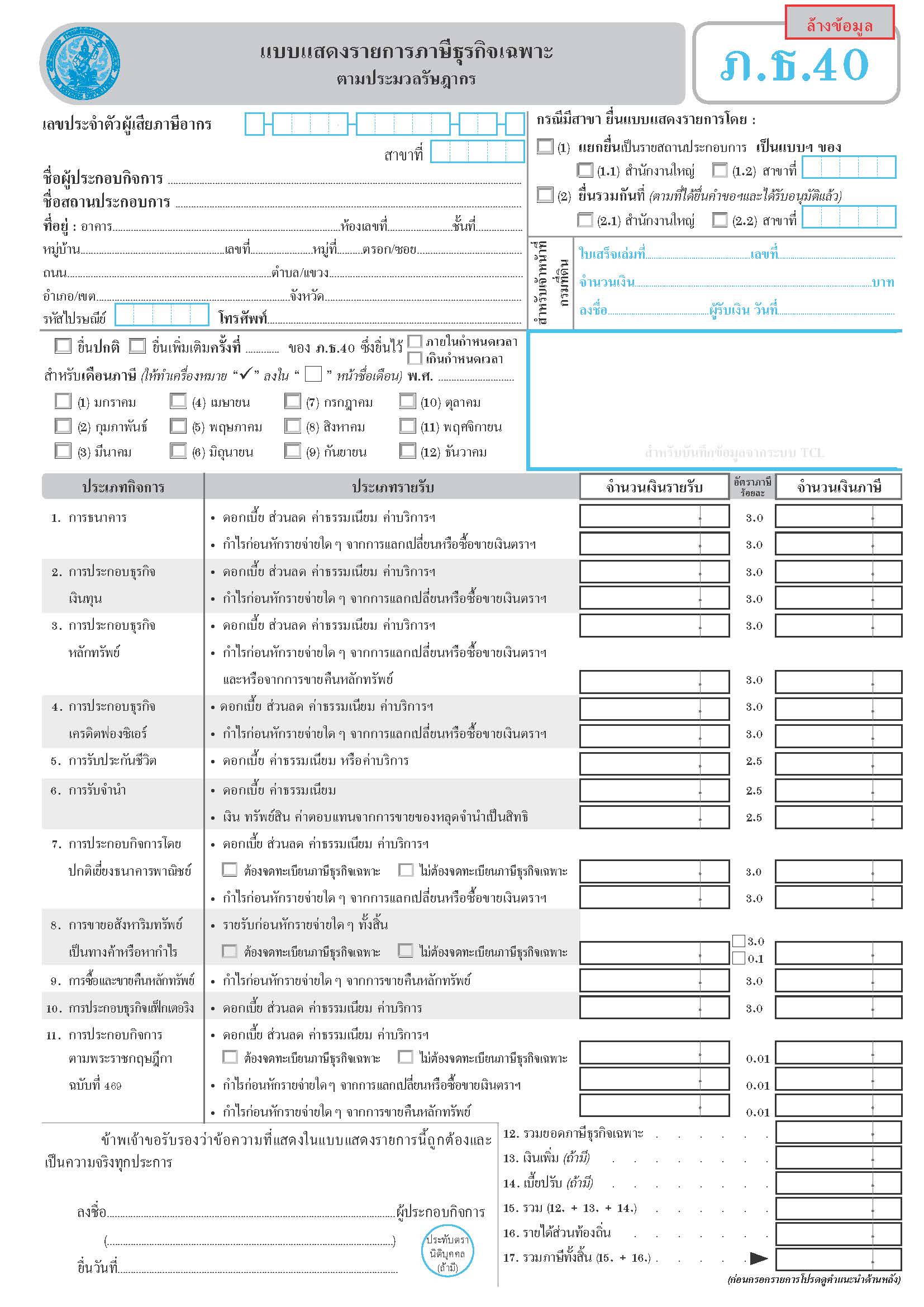

ตัวอย่าง แบบฟอร์มต่าง ๆ บริษัท หรือ ห้างหุ้นส่วน มีหน้าที่จะต้องยื่นแบบแสดง ต่อกรมสรรพากร

Examples of various forms, companies or partnerships are obliged to submit forms. to the Revenue Department

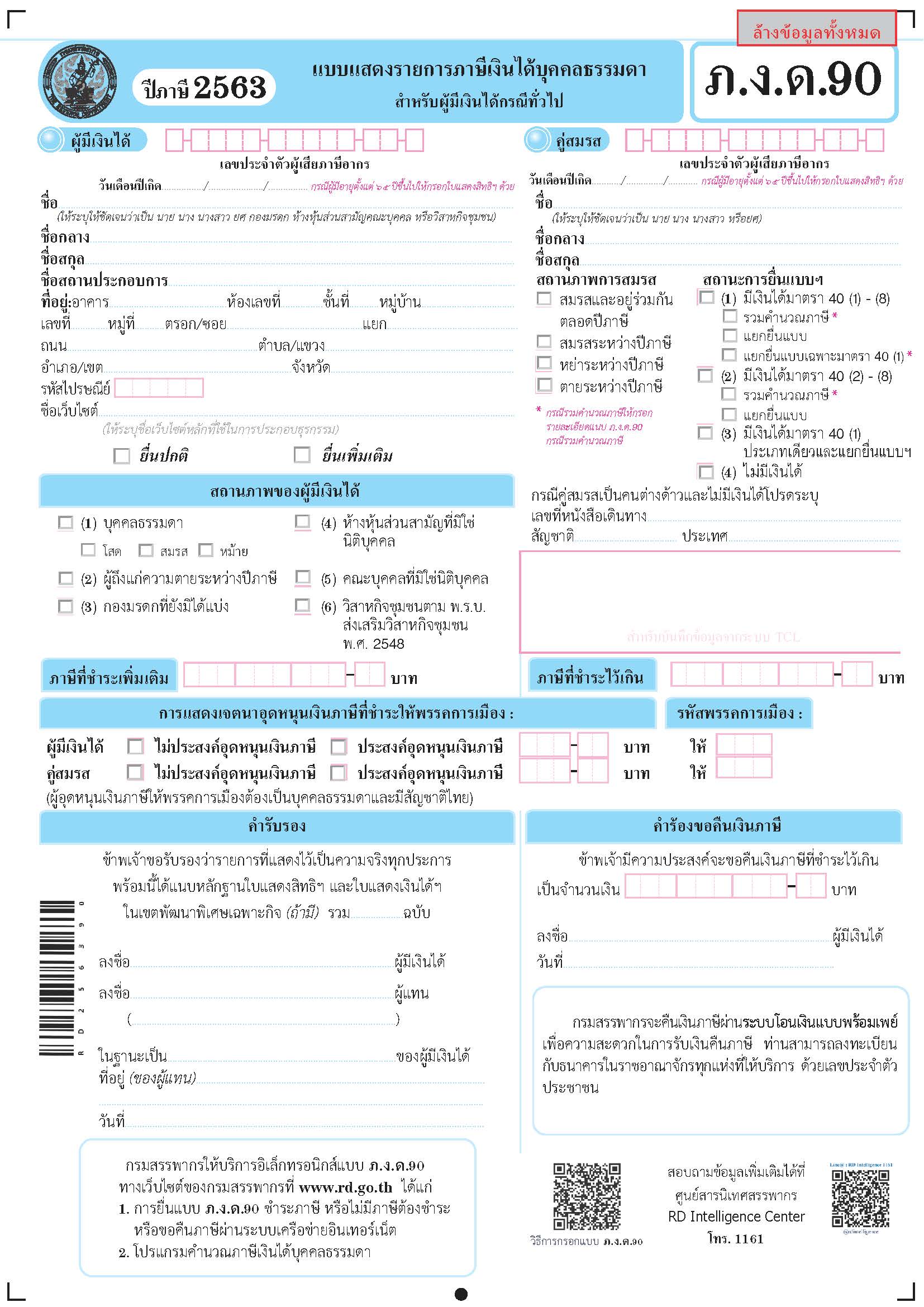

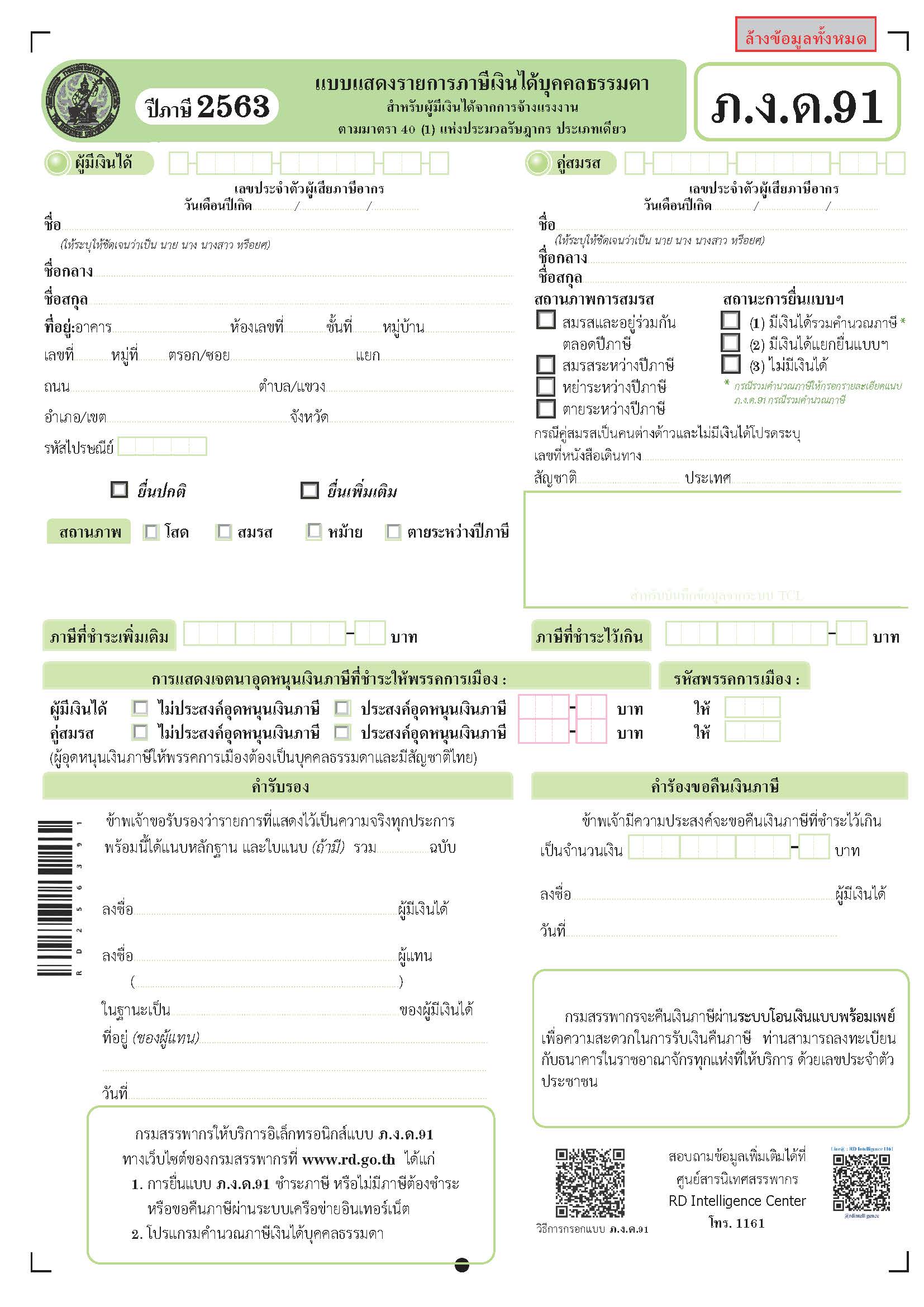

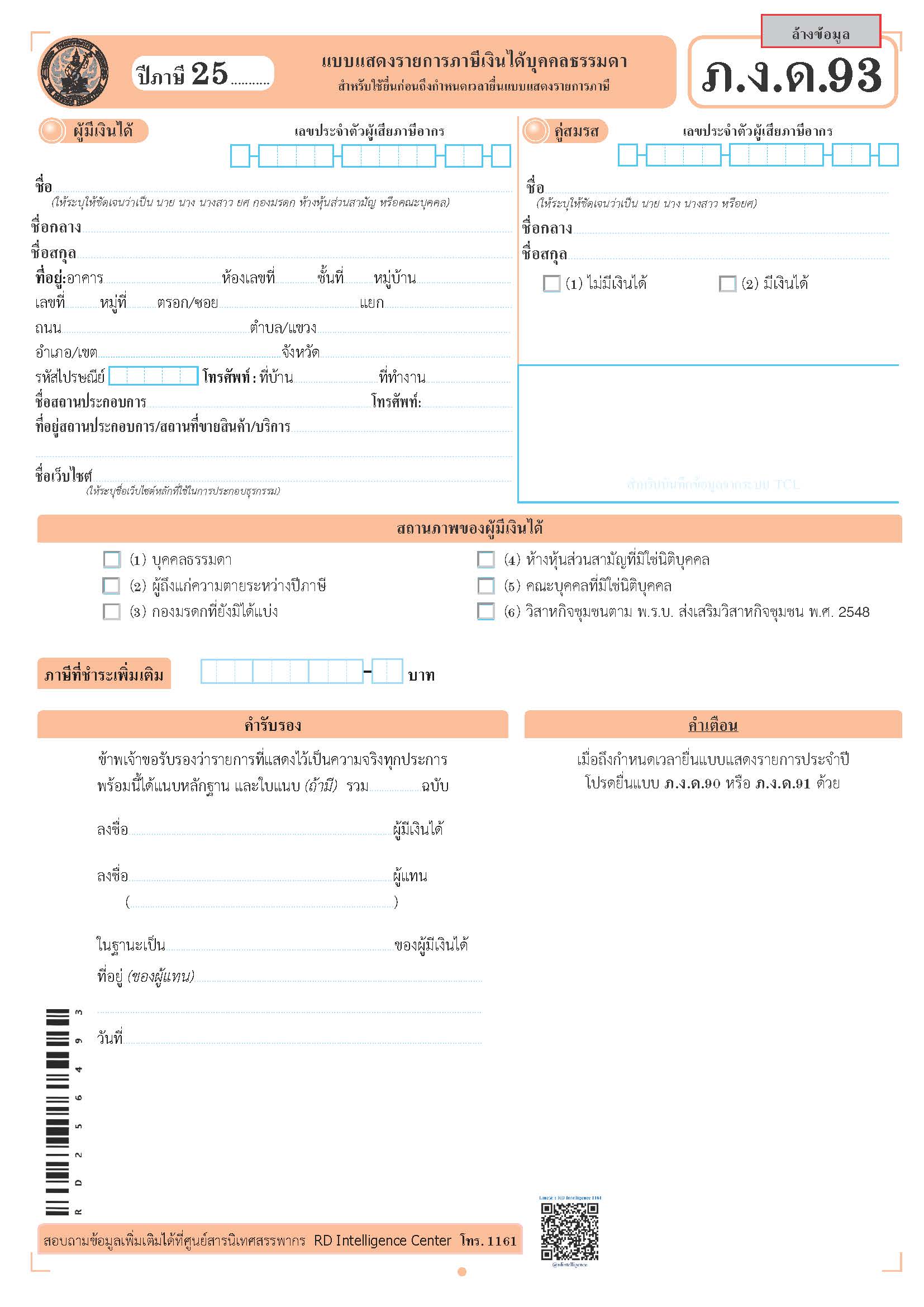

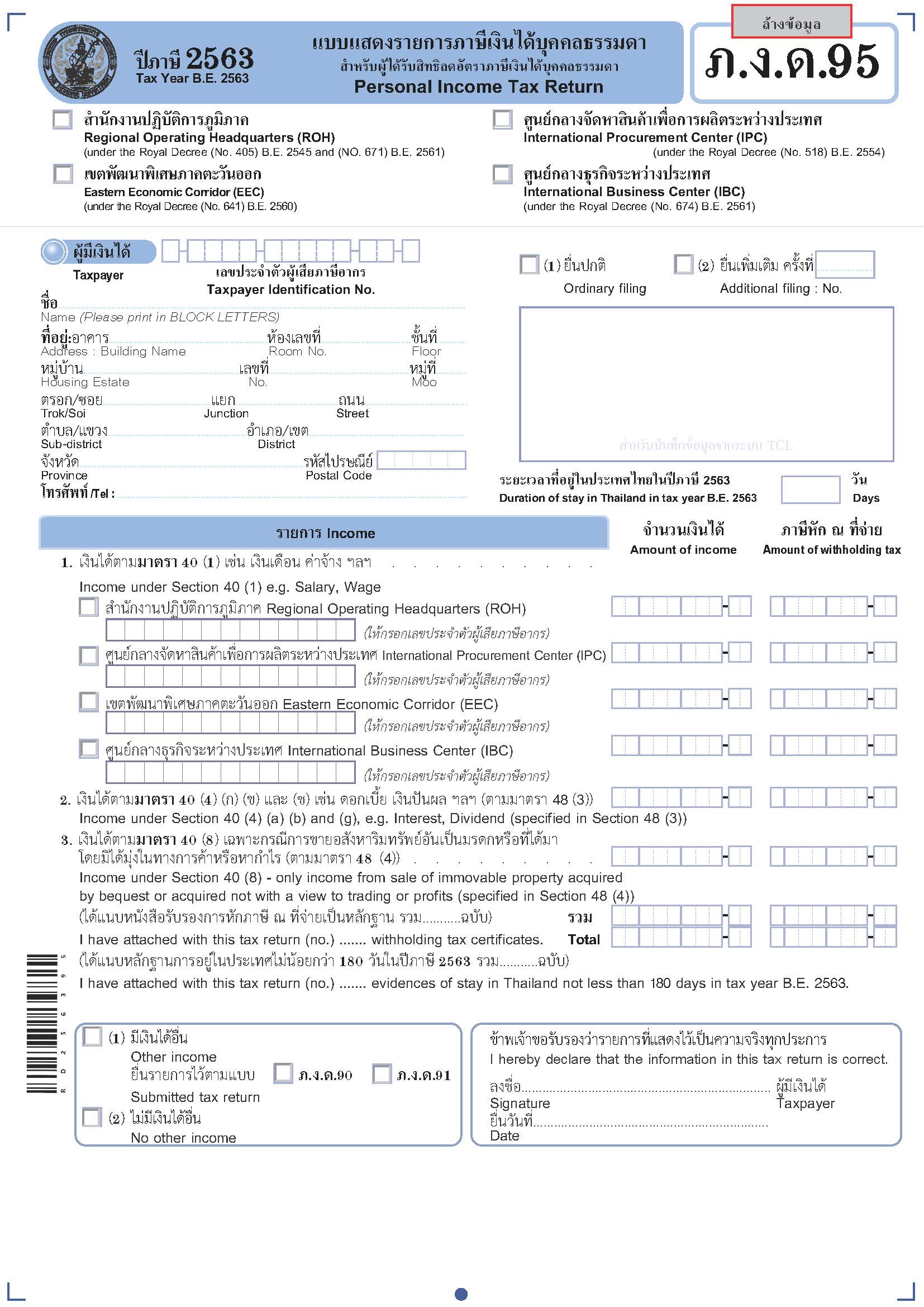

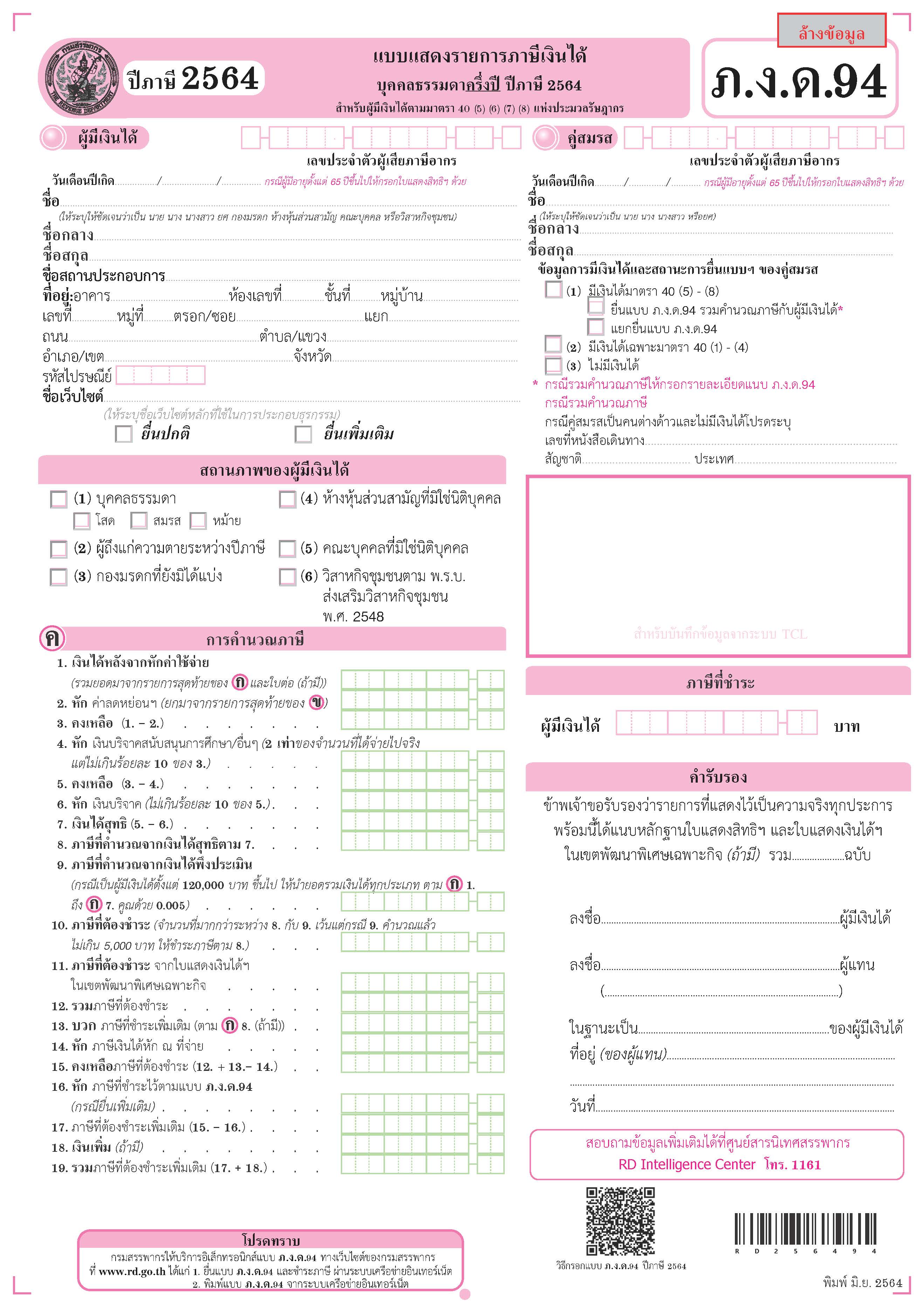

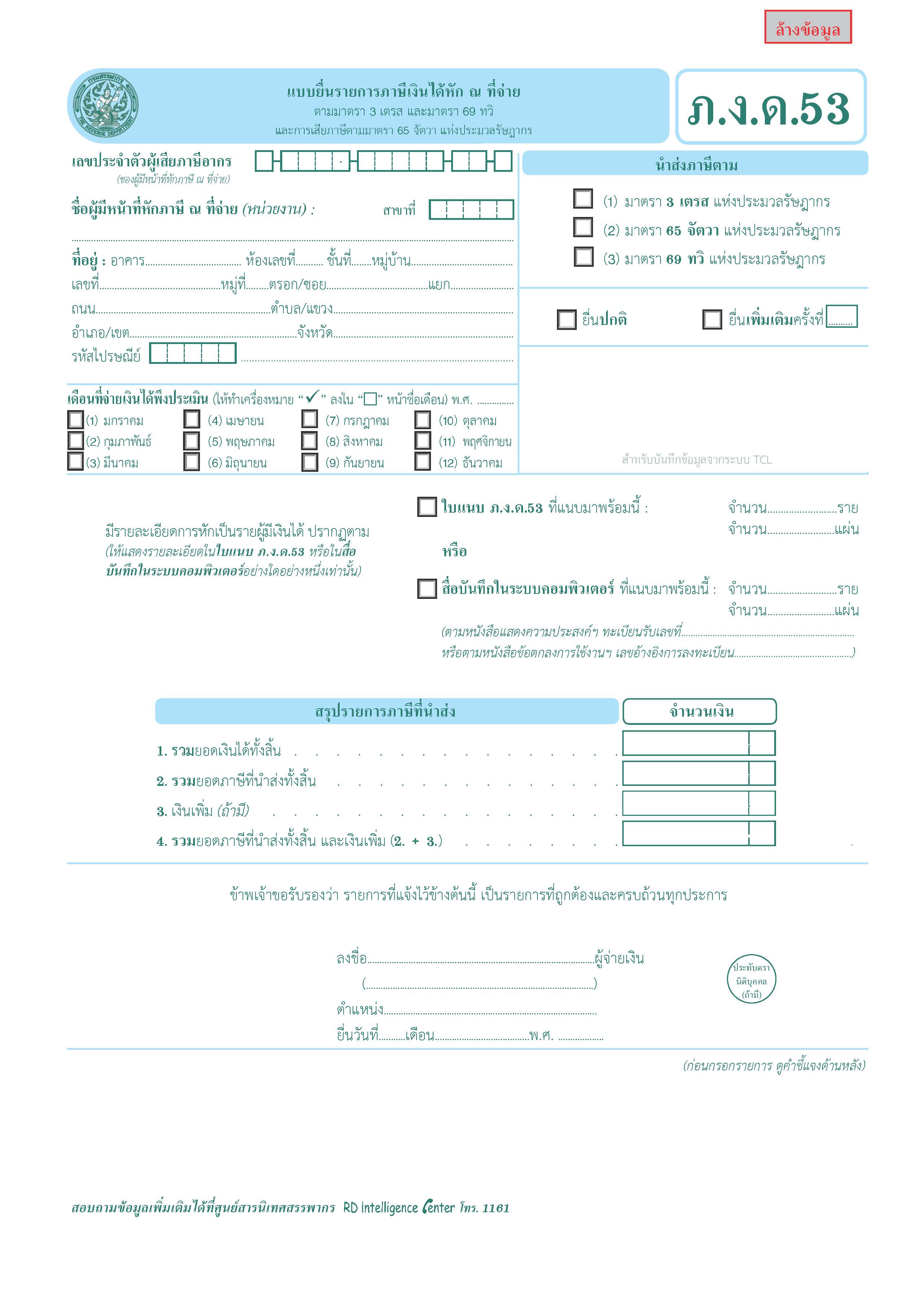

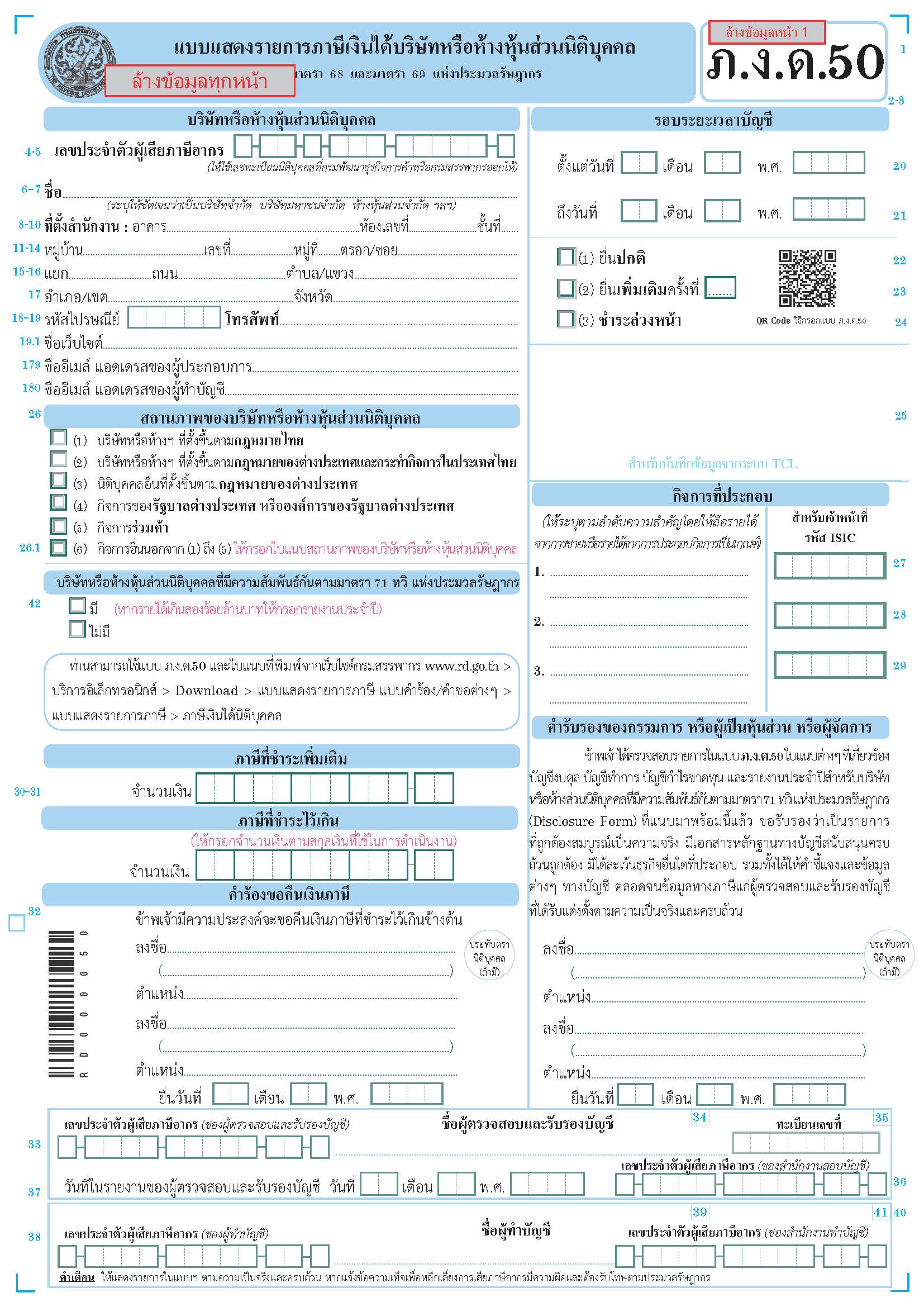

ตัวอย่าง แบบฟอร์มต่างๆ บุคคล มีหน้าที่ส่งแบบฟอร์ม ให้กับกรมสรรพากร

Examples of various forms The person is responsible for submitting the form. to the Revenue Department